-

- Sustainability

- Our environment

As a specialist lender, the impact of our business operations (Scope 1 and 2 emissions) is relatively low in comparison to the emissions associated with the finance we provide to our customers (Scope 3 category 15), and to a lesser extent those from the wider value chain (Scope 3 categories 1-14).

Our Climate Transition Plan gives priority to areas where we can deliver tangible value to our stakeholders, acting within our areas of influence, while seeking collaboration opportunities across sector.

The Group continue to purchase electricity from renewable tariffs supported by Renewable Energy Guarantees of Origin (REGO). 100% of electricity purchased in the UK came from renewable tariffs.

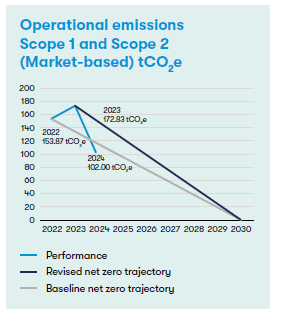

Our transition to net zero emissions by 2030 continues with tangible progress in Scope 1 and Scope 2 emissions. In 2024, we reduced operational emissions by 41% compared to 2023 and 34% from the baseline of 2022.

Notable achievements include the new Wolverhampton office design and fitout, which integrates energy-efficient technologies powered by renewable electricity, that contain lower Global Warming Potential fluorinated gases in cooling systems than the previous systems, LED lighting throughout, and sustainable materials such as carpets made from 75% recycled materials.

As we progress with reducing emissions, we continue to mitigate our impact by purchasing carbon credits from the Voluntary Carbon Market. Credits are carefully selected from a shortlist of verified and validated projects.

In 2024 we have expanded our Scope 3 reporting to include Categories 1 and 2, showing our ongoing commitment to transparency and accuracy in emissions measurement. Given the complexity of Scope 3 emissions (categories 1-14) we will continue to refine our understanding and actions.

The Group continue to measure the emissions from our mortgage lending portfolio using the Partnership for Carbon Accounting Financials (PCAF) methodology.

Approximately 96% of our total emissions stem from financed emissions, which arise from the properties we finance. These emissions are a key focus of our climate strategy.

In line with our Net-Zero Banking Alliance commitment we published our interim target for mortgage lending aiming to reducing the emissions intensity by 25% by 2030. Find out more about our Net Zero Banking Alliance Intermediate Targets.

In 2024, we saw a 19% reduction in financed emissions and a 18% reduction in emissions intensity compared to the 2022 baseline. This was primarily due to improved data quality and the exclusion of erroneous data included in the initial baseline.

As of 2025, we will review our targets to ensure they remain relevant, incorporating insights from the Climate Change Committee’s Seventh Carbon Budget and the Beyond Net Zero Pathway which was used to set the existing target.

This review will allow the Group to assess progress towards its ambition and interim target, beyond the gains made through data improvements.

Read more about our progress in 2024 and our priorities for the future.

Below are links to our Greenhouse gas emissions Basis’ or Reporting. These documents provide explanation of the collection and treatment of data used to compile emissions reporting as part of the Annual report and accounts.

Scope 1 and 2 – Basis of reporting